- Ai Guide

Resource for all things Tax-Relief

Do's and Dont's

- Ask Clear Questions: Make your questions simple and specific.

- Be Patient: Give the AI time to answer, especially for tough questions.

- Give Context: Share background info if it helps explain your question.

- Use Normal Language: Talk like you would to a friend; the AI understands regular speech.

- Correct Mistakes: If the AI gets something wrong, kindly correct it.

- Try Different Things: Ask various questions to see what the AI can do.

- Keep Personal Info Private: Don’t share things like your address or phone number.

- Give Feedback: Let the AI know if its answers are helpful or not.

- Be Vague: Don’t ask confusing or unclear questions.

- Use Bad Language: Avoid using rude or offensive words.

- Ask Too Many Questions at Once: Focus on one thing at a time.

- Expect Perfect Answers: The AI isn’t perfect and might make mistakes.

- Share Confidential Info: Never share passwords or other secret information.

- Ask Harmful Things: Don’t ask the AI to do anything illegal or dangerous.

- Think It Has Feelings: Remember, the AI doesn’t have emotions like a person.

- Forget Its Limits: The AI isn’t as smart as a human and has its limits.

- Do not upload pictures that are unrelated to your tax debt. Uploading images that are unrelated may result in a ban from using our AI Assistant.

- Avoid uploading pictures of notices containing your personal information. We recommend that you first obscure your name, social security number, and birth date. You can use white-out or a marker to cover this information before uploading.

- We will ban those the violate our policies

Play Video

Meanings of AI Assistant Symbols

Symbols guide for easy understanding of our AI assistant.

- Ask Button: click the button on the bottom right to launch our Ai.

- Preselected Questions: popular questions to begin with.

- Question Box: is where you type in your questions.

- Microphone: enables you to ask questions using your voice.

- PDF Upload: enables you to upload IRS documents in PDF format.

- Submit Button: after typing your question, send it with a click.

- Ai Thinking: indicates the AI is processing your question. Please be patient as it is handling thousands of queries per second.

- Expand Window: enlarges the chat window for a bigger view.

- Delete: enables you to remove all your conversation history.

- Exit Ai Chat: enables you to close your chat session with the AI assistant.

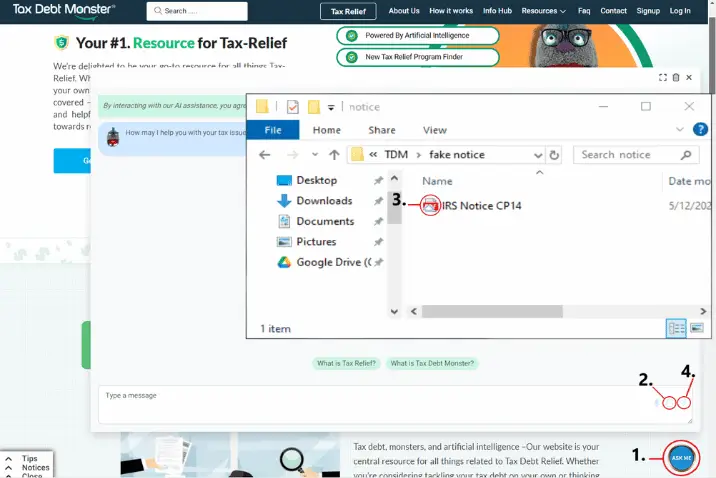

Uploading Letters, Notices & Transcripts PDF:

Our AI assistant can now assist you with your IRS letters, notices & transcripts. Our Ai can decipher IRS letters and notices and provide you with answers & solutions. Simply upload a PDF version of your Notice to our Ai Assistant.

Find the “ask me” button at the bottom right corner.

Click the upload button icon on the right-hand side, resembling a sheet of paper.

This opens your file explorer. Navigate to locate the PDF document you want to upload.

Beside the upload button, click the arrow button to enable the AI Assistant to recognize the document. The AI Assistant will respond accordingly.

Tip: Before uploading your IRS notice, letter, or transcript convert it into a PDF format. You can easily do this on your desktop. If you’re unsure how to convert it, click on this link to: Learn-More.

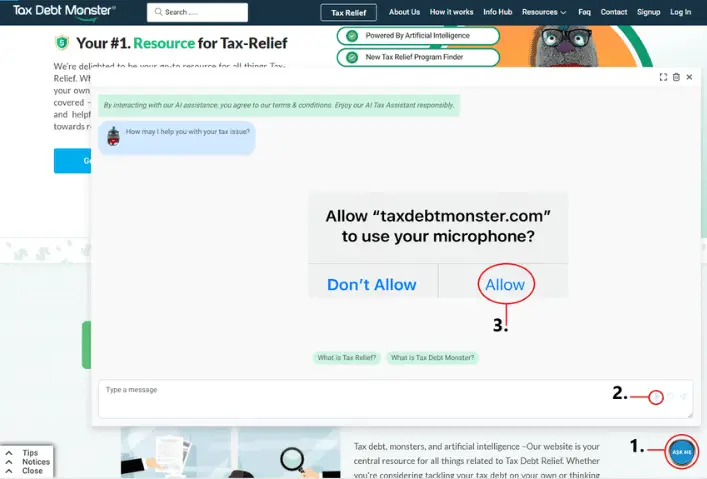

Ai Dialog Microphone Interaction:

We’ve merged ASR and TTS technologies. Now, your cellphone’s mic lets you talk to our AI Assistant. It transcribes your speech into text and turns responses into lifelike audio, giving you both text and voice feedback.

Find the “Ask Me” button positioned at the bottom right corner of the screen.

Click on the microphone-shaped icon located on the right-hand side of the button. A message will appear, requesting permission to access your microphone. Grant permission by clicking “Allow,” and the microphone icon will transform into a circle, indicating activation for the AI to listen to your commands.

Click on the microphone icon once more to conclude the conversation. The AI Assistant will respond accordingly.

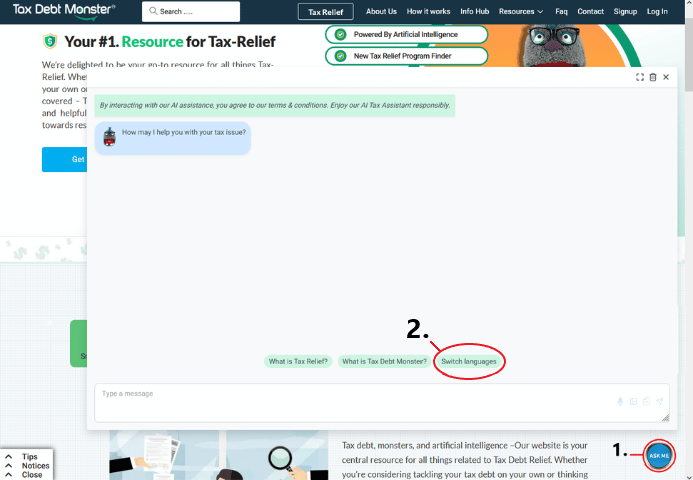

Multilingual Interpretation:

The Ai Assistant’s advanced language processing is designed to understand and respond in multiple languages, catering to users from different linguistic backgrounds. This inclusive feature promotes understanding and communication between cultures worldwide. By supporting diverse languages, our Ai Assistant allows individuals to interact with technology comfortably in their preferred language, fostering smoother cross-cultural exchanges. This dedication to linguistic diversity reflects our aim of building a global community where everyone feels included, encouraging collaboration and innovation across language barriers.

FAQs most people ask our AI Assistant

Here are some common questions that visitors typically ask our AI Assistant. Feel free to use these frequently asked questions that many users inquire about in our AI Assistant. Just copy and paste each question into the chat.

Please click here to view the questions: copy and paste the question of your choice.

- How much do I owe?

- What are my payment options?

- Can I negotiate with the IRS?

- What happens if I can’t pay the full amount?

- Are there any tax relief programs available?

- How do I avoid future tax debt?

- Can I discharge tax debt through bankruptcy?

- How long will the IRS pursue me for unpaid taxes?

- What are my rights as a taxpayer?

- How do I resolve tax debt from previous years?

- Will I face penalties for not paying on time?

- Can I set up a payment plan?

- Are there any tax credits or deductions I can claim to reduce my debt?

- How does interest accrue on tax debt?

- Can I appeal my tax debt?

- Will the IRS seize my assets if I can’t pay?

- Can I temporarily delay payment?

- What documents do I need to provide to resolve my tax debt?

- Can I request an abatement of penalties?

- What are the consequences of ignoring my tax debt?

- Can I transfer my tax debt to another person or entity?

- Can I apply for an Offer in Compromise?

- Will my tax debt affect my credit score?

- Can I get a tax refund if I have outstanding tax debt?

- How do I request a tax debt settlement?

- Can I deduct my tax debt payments on my tax return?

- What is the difference between tax debt and tax lien?

- Can I get a tax debt forgiven due to financial hardship?

- How do I report changes in my financial situation to the IRS?

- Can I pay my tax debt using a credit card?

- Can I dispute the amount of tax debt I owe?

- How do I know if I’m eligible for an IRS payment plan?

- Will my tax debt affect my ability to get a mortgage or loan?

- Can I use retirement funds to pay off tax debt without penalties?

- How does filing for bankruptcy affect tax debt?

- Can I get a tax debt settlement if I’m self-employed?

- Can I receive assistance from a tax professional to resolve my tax debt?

- Can I request a temporary suspension of IRS collection activities?

- Will the IRS negotiate with me directly or do I need legal representation?

- Can I deduct interest paid on tax debt from my income taxes?

- How do I request a tax debt forgiveness program?

- Can I still receive my tax refund if I have unpaid taxes?

- Can I lower my monthly payment amount for a payment plan?

- How long does it take for the IRS to process a payment plan request?

- Can I amend past tax returns to reduce my tax debt?

- Will the IRS accept a partial payment to settle my tax debt?

- Can I dispute penalties or interest charges on my tax debt?

- Will the IRS forgive penalties if I have a reasonable cause for not paying?

- Can I qualify for an Innocent Spouse Relief program if my spouse owes tax debt?

- Can I make a lump-sum payment to settle my tax debt?

- Can I get a tax debt settlement if I’m unemployed?

- Can I negotiate a lower interest rate on my tax debt?

- Can I transfer my tax debt to a credit card to avoid IRS penalties?

- Can I appeal a rejected Offer in Compromise?

- Can I avoid wage garnishment if I set up a payment plan?

- Can I get tax debt relief if I’m experiencing a natural disaster?

- Can I dispute the accuracy of the IRS’s assessment of my tax debt?

- Can I qualify for a Currently Not Collectible status if I can’t afford to pay?

- Can I get tax debt relief if I’m a victim of identity theft?

- Can I apply for a tax debt relief program if I’m a senior citizen?

- Can I receive tax debt relief if I’m a military service member?

- Can I get tax debt relief if I’m a low-income taxpayer?

- Can I receive assistance from a taxpayer advocate to resolve my tax debt?

- Can I get tax debt relief if I’m permanently disabled?

- Can I receive assistance from a nonprofit organization to resolve my tax debt?

- Can I negotiate a settlement for my business tax debt?

- Can I deduct tax debt settlement fees on my tax return?

- Can I request an extension to pay my tax debt?

- Can I get tax debt relief if I’m a victim of tax preparer fraud?

- Can I receive assistance from a community organization to resolve my tax debt?

- Can I qualify for tax debt relief if I’m a student?

- Can I receive tax debt relief if I’m a single parent?

- Can I negotiate a payment plan based on my income and expenses?

- Can I receive assistance from a religious organization to resolve my tax debt?

- Can I get tax debt relief if I’m a homeowner facing foreclosure?

- Can I request a reduction in my tax debt based on financial hardship?

- Can I receive tax debt relief if I’m a small business owner?

- Can I receive assistance from a legal aid organization to resolve my tax debt?

- Can I negotiate a compromise based on the value of my assets?

- Can I qualify for tax debt relief if I’m a nonresident alien?

- Can I receive tax debt relief if I’m a victim of domestic abuse?

- Can I get tax debt relief if I’m a freelancer or gig worker?

- Can I receive assistance from a social services agency to resolve my tax debt?

- Can I negotiate a settlement for my payroll tax debt?

- Can I receive tax debt relief if I’m a homeowner facing eviction?

- Can I receive assistance from a financial counselor to resolve my tax debt?

- Can I get tax debt relief if I’m a victim of investment fraud?

- Can I negotiate a settlement for my state tax debt?

- Can I receive tax debt relief if I’m a member of a tribal community?

- Can I receive assistance from a consumer advocacy group to resolve my tax debt?

- Can I negotiate a payment plan based on my health expenses?

- Can I receive tax debt relief if I’m a veteran?

- Can I negotiate a compromise based on my job loss?

- Can I receive assistance from a credit counseling agency to resolve my tax debt?

- Can I negotiate a settlement for my property tax debt?

- Can I receive tax debt relief if I’m a survivor of a natural disaster?

- Can I negotiate a payment plan based on my child support payments?

- Can I receive assistance from a pro bono attorney to resolve my tax debt?

- Can I negotiate a compromise based on my medical debt?

- Can I receive tax debt relief if I’m a victim of tax evasion by a family member or spouse?